How to Sell My House for Cash in Manchester

- Published on

- 10 min read

-

Cheyenne Wiseman Associate EditorCloseCheyenne Wiseman Associate Editor

Cheyenne Wiseman is an Associate Editor at HomeLight.com. Previously, she worked as a writer for Static Media (Mashed.com and Chowhound.com) and as an editor for CBR.com. Cheyenne holds a bachelor’s degree in English from UC Davis, where she also founded and led a literary magazine called Open Ceilings. She has four years of experience writing and editing on topics including real estate, financial advising, and pharmaceuticals.

If you’re asking, “Should I sell my house for cash in Manchester?” chances are you want a simple, quick sale without the hassle of repairs or open houses. Whether you’re downsizing from a colonial near the Merrimack or parting with a downtown condo, a cash sale can help you move on your timeline.

In this post, we’ll outline your main options for getting an all-cash offer in New Hampshire’s largest city. We’ll also look at how your home’s condition, location, and market trends may influence the price you receive.

Options to sell my house for cash in Manchester

Homeowners in Manchester generally have two main paths to a cash sale: sell directly to a local house-buying company or investor, or work with a real estate agent who can connect you with qualified cash buyers. Each option can lead to a different level of proceeds.

Before we get into the details, use the calculator below for a quick idea of what your Manchester cash offer could look like, depending on how you choose to sell.

As you can see, cash offers tend to be stronger for homes in good shape — but not every homeowner has the time, budget, or bandwidth to make updates. For sellers facing a sudden move, job relocation, or the sale of an inherited property, the convenience of an all-cash offer can make the process stress-free.

Let’s take a look at what to expect from each way to sell a house for cash in Manchester.

Option 1: Sell to a cash buyer company in Manchester

Cash buyer companies and investors make a business of purchasing homes for cash — often “as is.” That means no cleaning, staging, or repairs to your Manchester property, no matter its condition. These local and national companies are commonly known as “We Buy Houses” firms.

Other house-buying companies in Manchester, known as iBuyers, only purchase homes in good condition or move-in-ready “turnkey properties.” The most well-known iBuyers are Opendoor and Offerpad — these companies pay higher cash offers but charge a fee of around 5% of the home’s price.

Most We Buy Houses companies in Manchester follow a similar straightforward process:

- You share information about your Manchester home online or by phone.

- They assess the home’s value using local market data and an on-site visit.

- You receive a no-pressure cash offer, often within 24 to 48 hours.

- If you accept, closing can happen in as little as 7 to 14 days.

Some Manchester investors flip homes for resale, while others rent or hold them long-term. Their goal is usually to purchase below market value to make a profit.

Many follow the 70% rule of house flipping, meaning they’ll pay about 70% of the home’s after-repair value (ARV), minus repair costs. Our calculator above applies a formula to show a range of the 70% rule and an 80% guideline that many rental property investors use.

Still, these numbers vary depending on the neighborhood — a fixer-upper in Rimmon Heights may get a different offer than a turnkey home near Derryfield Park.

»Learn more: 9 Top Companies that Buy Houses for Cash in 2025

Pros and cons of selling to a Manchester cash buyer company

| Pros | Cons |

| Quick to close: Close and get paid in days, not months | Lower sale price: Offers typically fall below market value |

| No repairs or upgrades: Sell your Manchester home in its current condition | No negotiation: Expect firm, non-negotiable offers |

| Hassle-free approach: No showings, open houses, or negotiations to deal with | Less competition: You’re not showing your house to multiple buyers |

| No fees or commissions: Most companies take care of closing costs | Not right for everyone: An agent-led sale can benefit some |

| Sale is certain: There’s no risk of a sale falling through due to financing setbacks | Risk of scams: Some buyers lack credentials or transparency |

While many reputable investors operate in Manchester, it’s important to stay alert for signs of a bad deal. Avoid anyone who pressures you, lacks an online presence, or doesn’t provide clear terms. Look for local references, verified reviews, and experience in the Manchester market.

»Learn more: We Buy Houses Pros and Cons: Make an Informed Decision

A better way to find trusted cash buyers in Manchester

HomeLight’s Simple Sale platform takes the guesswork out of finding a trustworthy cash buyer. It connects you with the nation’s largest network of pre-vetted buyers — including many active in the Queen City — so you can compare offers without sorting through dozens of investor websites yourself.

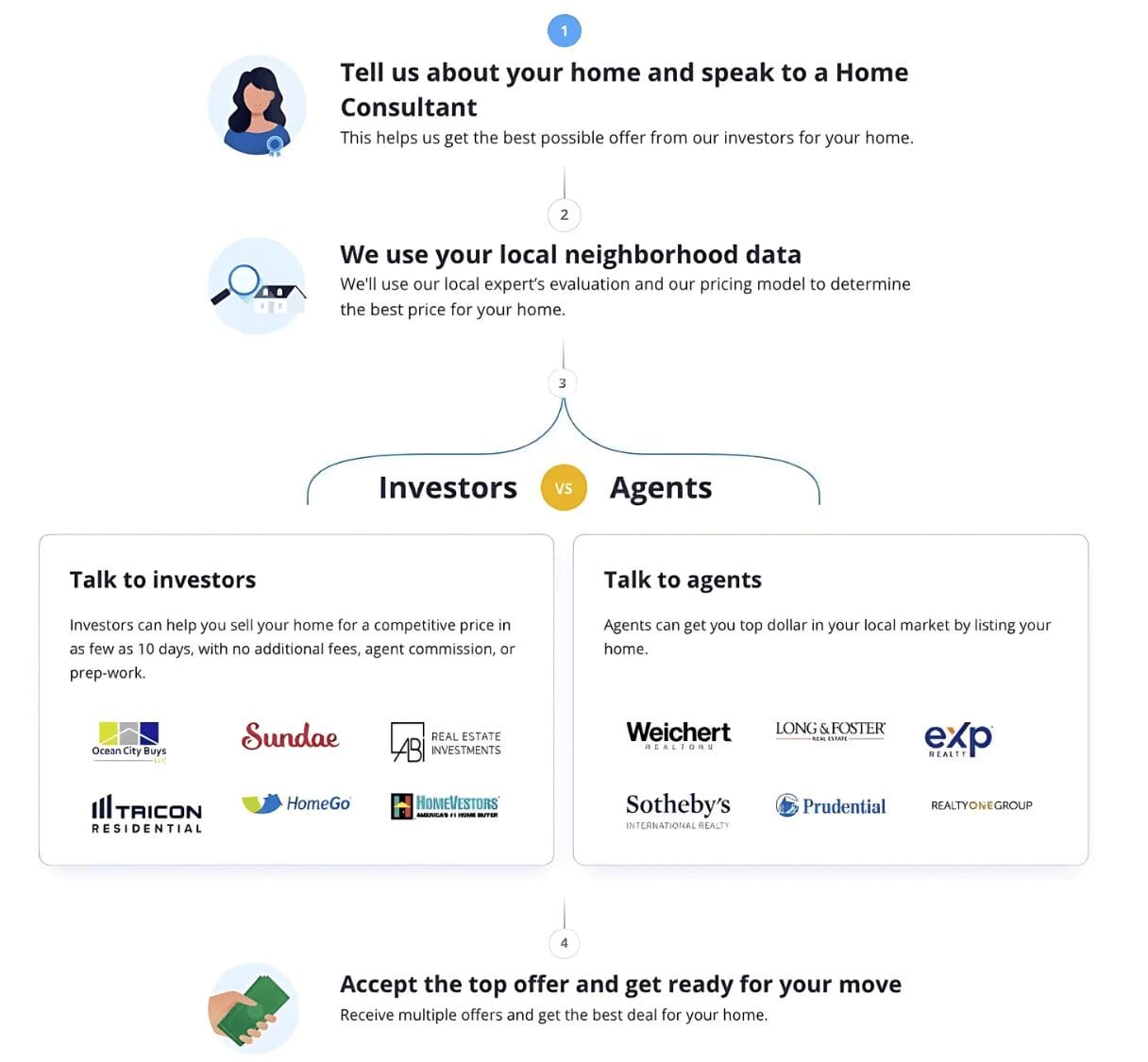

Here’s the four-step Simple Sale process:

Here’s how it works: You’ll share a few details about your Manchester home and receive a no-obligation cash offer within 24 hours. If you decide to move forward, you can close in as few as 7 days or choose your preferred closing date. You’ll also get an expert estimate of what your home might sell for with a top Manchester agent, giving you side-by-side options to decide what’s best.

Option 2: Attract a cash buyer with a top Manchester agent

Not all cash buyers are investors. In Manchester’s competitive housing market, plenty of individuals are coming in with cash — whether they’ve sold a home in Massachusetts, are downsizing after retirement, or are relocating for work at one of the city’s growing tech or healthcare employers. A top local agent knows how to attract these motivated buyers.

»Learn more: Why Hire a Real Estate Agent When You’re Selling or Buying

Pros and cons of selling with a top Manchester agent

| Pros | Cons |

| Higher sale price: Agents can boost visibility and attract multiple offers | Slower timeline: A traditional listing can take weeks or months to close |

| Professional help: Pricing, marketing, and negotiations handled for you | Prep work: You’ll likely need to clean, stage, or make repairs |

| Broad exposure: MLS and agent networks bring in more buyers | Showings: Expect some disruption to your daily routine |

| Reduced stress: You’ll avoid legal or logistical missteps | Commission fees: You’ll need to budget for agent fees (a percentage of the sale price) |

| Legal protection: Ensures compliance with disclosure and federal fair housing laws | Uncertain outcome: There’s no guarantee of multiple offers, and deals can fall apart |

»Learn more: Should I Sell to a Home Investor or List With an Agent?

The easy way to find top-rated Manchester agents

If you decide to list with an agent, HomeLight’s free Agent Match platform can connect you with Manchester’s best performers based on real sales data. We analyze more than 27 million transactions and thousands of reviews to find agents with a proven record of fast, profitable sales.

Whether your goal is to attract cash offers or maximize your sale price, the right Manchester agent can make it happen. For a no-obligation consultation with a trusted local professional, tell us a bit about your goals and timeline.

What can affect your cash offer price in Manchester?

In Manchester, your home’s condition and location play a major role in shaping cash offers. Well-maintained homes near Elm Street, the millyard, or North End often attract stronger interest, while properties needing repairs may sell below market value.

Market trends also matter. As of September 2025, the median home price in Manchester sits at $500,000, and homes typically go under contract in 17 days. With limited inventory and steady demand from Boston commuters and relocating professionals, updated homes in desirable areas tend to bring higher offers.

Want to know what your Manchester home might be worth? Try HomeLight’s free Home Value Estimator to quickly compare your property against today’s market.

Which cash sale option is right for you?

If you’re looking for a fast, stress-free way to sell your Manchester home, working with a vetted Manchester cash buyer through HomeLight’s Simple Sale platform could be your best move. You can skip repairs, avoid open houses, and close on your own schedule — whether your home sits near McIntyre Ski Area or the historic millyard.

If your goal is to get top dollar, and you don’t mind doing a little prep work, partnering with a top Manchester agent might make more sense.

When you request a Simple Sale offer, you’ll also receive a professional estimate of what your home could fetch with an agent, so you can easily compare both routes.

Still wondering, “What’s the best way to sell my house for cash in Manchester?” Use the Home Cash Offer Comparison Calculator above to see what your Manchester home might sell for under different scenarios — then request a no-obligation offer or connect with a trusted local expert to decide what works best for you.

Header Image Source: (Im3rd Media/ Unsplash)