How to Sell a House by Owner in Texas

- Published on

- 15 min read

-

Erika Riley, Contributing AuthorClose

Erika Riley, Contributing AuthorClose Erika Riley Contributing Author

Erika Riley Contributing AuthorErika Riley is a journalist who has written about home design and real estate in a variety of outlets primarily in New York City. Now based in the D.C. Metro area, Erika enjoys painting her furniture too many times and finding the prettiest townhouses to walk by.

-

Taryn Tacher, Senior EditorClose

Taryn Tacher, Senior EditorClose Taryn Tacher Senior Editor

Taryn Tacher Senior EditorTaryn Tacher is the senior editorial operations manager and senior editor for HomeLight's Resource Centers. With eight years of editorial and operations experience, she previously managed editorial operations at Contently and content partnerships at Conde Nast. Taryn holds a bachelor's from the University of Florida College of Journalism, and she's written for GQ, Teen Vogue, Glamour, Allure, and Variety.

For some Texans looking to sell their homes, the top priorities include avoiding realtor commissions and taking control of the sale process. They choose the For Sale By Owner (FSBO) route to save money and manage marketing, negotiations, and showings themselves. While FSBO can work, it comes with some risks and drawbacks, which may be the reason it’s not a popular selling approach.

According to the National Association of Realtors, only 6% of total home sales in 2023 were FSBO. If you’re determined to choose this route despite its unpopularity, read this guide on how to sell a house by owner in Texas, as it covers what can be the most difficult aspects of selling by owner. We also provide a comprehensive overview of the full process to prep, market, and close on your home without the assistance of a real estate agent.

Fast Facts About Selling a House in Texas

| Median sales price | $332K (aggregate data) |

| Average days on market | 63 days (aggregate data) |

| Are FSBO yard signs allowed? | Regulations governing signs, including sizing and placement, are determined at the local level. |

| Is a real estate attorney required? | Real estate attorneys are not considered essential for closing in Texas. However, it’s almost always recommended to involve the expertise of an attorney when selling FSBO to prevent a potential abundance of legal risk. |

| What are sellers required to disclose in Texas? | The seller’s knowledge of the condition of the property must be documented in the Texas Real Estate Commission’s Seller’s Disclosure Form |

| Real estate transfer taxes? | None |

Quick FSBO overview

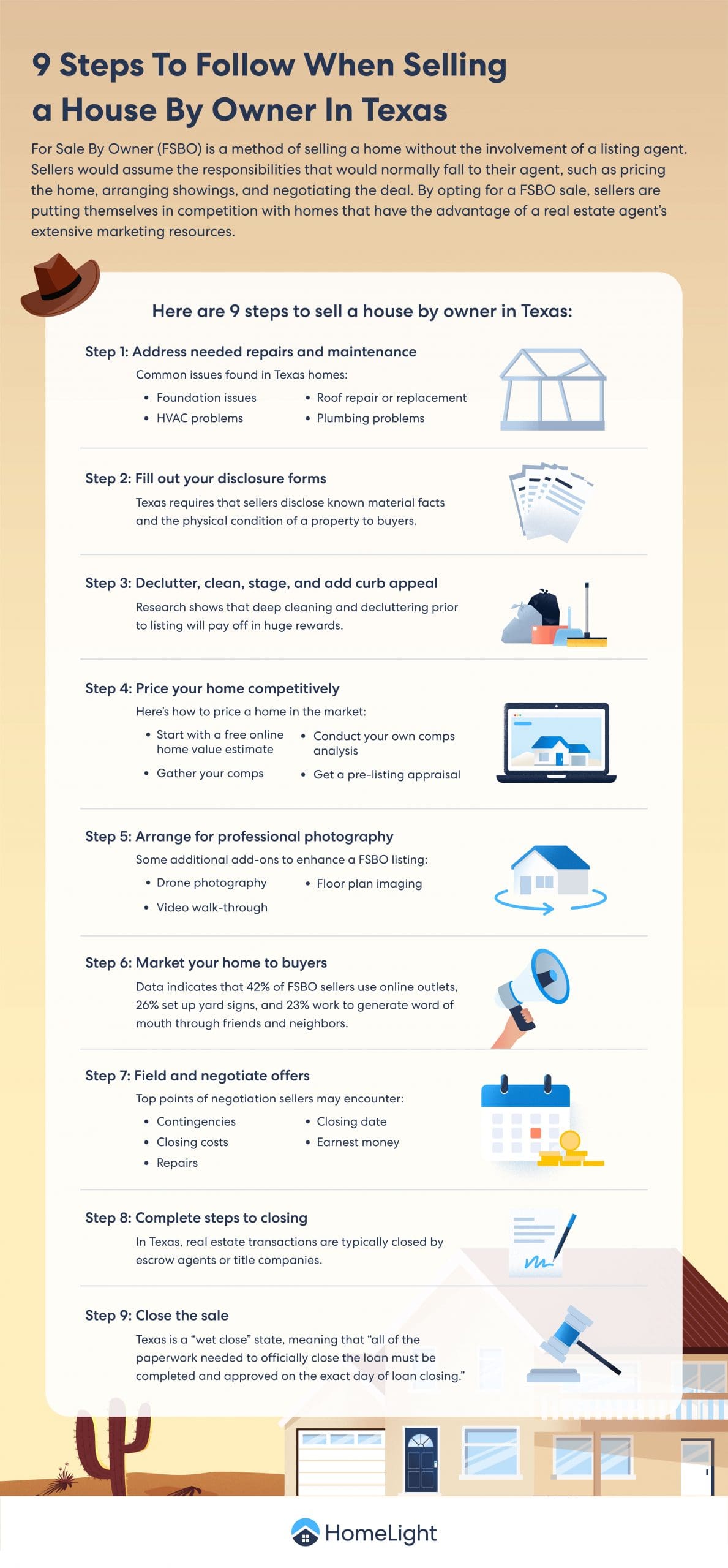

FSBO is a method of selling your home without the involvement of a listing agent. In a FSBO scenario, the seller assumes the responsibilities that would normally fall to their agent, such as pricing the home, arranging showings, and negotiating the deal. This lets homeowners save on agent commissions.

Agent commissions

For decades, the seller has been responsible for paying agent commissions, which typically range from 5% to 6% of the home’s sale price in a traditional agent-assisted sale. This fee was split between the listing agent and the buyer’s agent. However, agent commission rules have changed following the historic NAR lawsuit settlement.

Under the new commission structure, sellers are no longer required to pay their buyer’s agent’s fee, as buyers are expected to negotiate directly with their agents. Thus, sellers working with an agent only have to cover their listing agent’s fee, which is about 2.5% to 3% of the home’s sale price, depending on negotiations.

But while these new rules aim to reduce fees, some sellers still feel the need to cover the buyer’s agent’s fees to entice more buyers or expedite a sale. Thus, if you partner with a realtor, you may be looking at paying a commission of 3% (your listing agent’s fee) to 6% (your listing agent’s fee and your buyer’s agent’s fee) of the home’s sale price.

Commission savings

By selling FSBO, you can eliminate the cost of the agent commissions since you won’t have a listing agent. If you decide to cover the buyer’s agent’s fee, you’ll only pay around 2.5% to 3% of the home’s sale price, still saving you a good chunk of money.

Even with new commission rules in place and in a FSBO transaction, buyer’s agents expect compensation for the work they do to bring a buyer to a sale, such as arranging showings and helping to tee up and qualify the buyer. Plus, when a seller isn’t working with an agent, the buyer’s agent may end up carrying more of the weight to get the deal to the finish line.

Next: Consult our guide on who pays closing costs when selling a house by owner for more details.

A FSBO sale does not mean that a seller won’t need professional assistance. In Texas, sellers are not required to hire a real estate attorney, but FSBO sales typically warrant legal and professional oversight to avoid an abundance of legal risk.

Most people who sell by owner will need to hire an attorney to review and prepare key documents and make sure paperwork is filled out properly, such as the seller’s disclosures. We’ll address what disclosures are required when selling a house in Texas later in this post.

How to sell a house by owner in Texas

By opting for a FSBO sale, you’re putting yourself in competition with homes that have the advantage of a real estate agent’s extensive marketing resources. Nonetheless, by following the steps below, you can give your home a better chance of resembling a professional listing and attracting the attention of potential buyers.

Step 1: Address needed repairs and maintenance

FSBO sellers in Texas may consider getting a home inspection prior to listing their home for sale. Addressing any issues upfront helps buyers have peace of mind when making an offer. However, be aware that if you get a pre-listing inspection, you will be required to share relevant findings with buyers and how you did or did not address them.

Problems commonly found in Texas homes:

- Foundation issues. Texas is known for its challenging foundation problems, largely due to shifting soil across the state. Cities here are often impacted by soil conditions like expansive clay, which shifts and settles, leading to potential foundation issues.

- HVAC problems. Texas temperatures can vary widely, but you can bet on sweltering summers, with highs often rising above 100 degrees. Soaring temperatures mean the air conditioning has to work longer and harder, which can damage HVAC systems.

- Roof damage. Texas might be best known for its hot, arid climate, but it can also experience cold winters, hurricanes, hailstorms, tornadoes, and thunderstorms, as well as the threat of wildfires. All of these potentially extreme conditions can wreak havoc on a home’s roof, especially when it was created with a less-than-durable or resilient material.

- Plumbing troubles. Heavy rainfall in Texas can cause ground movement around a home’s slab, disrupting the pipes and causing leaks. In addition to skyrocketing water costs, leaky pipes can be expensive to repair or replace.

Step 2: Fill out your disclosure forms

Texas requires that sellers disclose known material facts and the physical condition of a property to buyers. The Texas Real Estate Commission created the Seller’s Disclosure Notice, which allows sellers to report all conditions that Texas law requires to be disclosed.

A good time to fill out your Texas property disclosure is before listing your home so that you know it’s taken care of. The form asks for information about the condition of all physical aspects of a house, including windows, roof, walls, foundation, and electrical system.

It asks sellers to disclose environmental information about the property’s location within a groundwater conservation district and flood zone, and whether the owner presently has flood insurance. The form covers questions about appliances and other fixtures, like smoke detectors.

You may consider engaging the expertise of a real estate attorney to assist in this step in the process to reduce potential legal risk.

Step 3: Declutter, clean, stage, and add curb appeal

Research shows that deep cleaning and decluttering your home prior to listing will pay off in huge rewards. In fact, a HomeLight survey of top agents shows that decluttering can generate an additional $11,706 in proceeds. Well worth a weekend’s work! (Or the cost of a professional, if you so choose.)

You may also want to consider strategically staging your home so that buyers can envision how each space could be used. Professionally staged homes often sell for a higher price than those that aren’t staged because they highlight the home’s potential and create an inviting atmosphere, resulting in increased demand and offers.

Finally, don’t forget about staging the outdoors. Great curb appeal will help get buyers in the door.

Without the independent advice of a real estate agent, FSBO sellers can invite over friends and family for an honest opinion of how the house looks: Will it pass muster with buyers, or do some spaces in the house need a bit more attention?

Step 4: Price your home competitively

When selling a house by owner, you need to set the right asking price for your home. If you price it too high, your property is likely to be on the market longer than necessary. If you price it too low, you could significantly undersell it.

Follow these steps to price your Texas house for the market:

Start with a free online home value estimate

As a starting point, look at several online estimators for your home’s value. HomeLight’s Home Value Estimator aggregates publicly available data, such as tax records and assessments, your home’s last sale price, and recent sales records for other properties in the same neighborhood of your Texas home.

Gather your comps

Comps are recently sold homes comparable to yours in characteristics such as size, age, condition, and major features. The most reliable comps are going to be those within as close of a radius as possible to the location where you’re selling a property. Since you won’t be able to access multiple listing service (MLS) data without a real estate license, you’ll need to look at major home search sites to collect your data.

Conduct your own comps analysis

Compare your home’s features against the nearby comps you collected. The houses you studied should give an indication of an appropriate price range for your home. From there, you can make dollar adjustments based on characteristics that add value (pools, new floors, an extra bedroom) versus detract from it (a busy street, deferred maintenance, less square footage).

Get a pre-listing appraisal

A DIY comps analysis is risky if you don’t have a ton of experience making sense of property data. Alternatively, you could pay for a pre-listing appraisal. An appraiser will combine desk research with an onsite visit to your home to provide a professional and independent opinion of value.

Appraisals usually cost $357 on average, and getting one doesn’t mean that a buyer’s lender won’t require a separate and independent appraisal before closing. But it can reduce some of the stress of pricing your home for sale since appraisers are licensed and trained for this work.

Step 5: Arrange for professional photography

For $200-$400 per hour for a shoot, FSBO sellers should consider the benefits of getting professional photos to include in their listings. A professional photographer will take steps to shoot each room from the best angle, ensure optimal interior and natural lighting, and edit for the ideal brightness and exposure.

A high-quality camera with a wide-angle lens is also essential to showcasing entire rooms rather than half or three-quarters of what’s there. For these reasons and more, professionally photographed homes can sell faster than houses marketed without high-quality photos.

In addition to professional photography, consider these additional add-ons to enhance your FSBO listing:

- Drone photography. Getting an aerial view of the property can help buyers see the location and layout. Homes with drone photos tend to sell more quickly, as they provide unique views of the property and its surroundings.

- Video walk-through. A professionally edited video walk-through will help attract out-of-town buyers who might not be able to come for an in-person showing.

- Floor plan imaging. Having a 2D or 3D floor plan allows buyers to better understand the spatial layout and how the different areas of the home are connected.

Research shows that 44% of homebuyers begin their home search by browsing properties online. About 41% find photos to be useful in the process. Your home’s visual online presence is important, which is why even the best cell phone pictures can’t compete with professional images.

When selling a house by owner in Texas, the seller needs to arrange for photography services on their own and budget for them as part of their listing expenses. When working with a full-service real estate agent, professional listing photography is almost always going to be included — and many agents offer aerial photography and 3D tours as part of their listing package.

“FSBO sellers often believe they’re eliminating the fees by doing it on their own, but they’re going to have to do their own marketing,” explains Maribel Frey, a top real estate agent in San Antonio.

Step 6: Market your home to buyers

When it comes to marketing your home, you’ll do yourself a favor by posting across multiple platforms for visibility. Data indicates that about 30% of FSBO sellers use online outlets, 19% set up yard signs, and 20% work to generate word of mouth through friends and neighbors.

Listing on the MLS will increase your property’s visibility. As a FSBO seller, you can opt to have your property listed on the MLS for a flat fee or employ a listing service that charges a percentage of the sales price for services that include MLS access.

Step 7: Field and negotiate offers

Your strategic marketing efforts would eventually lead to one or more offers on your Texas property. But not every offer is a good offer. As a FSBO seller, you’ll be responsible for negotiating a contract you’re satisfied with.

Price is a major factor, as are other details of the agreement, such as whether you’ll cover any of the buyer’s closing costs, when you’ll agree to move out, and which contingencies will be included in the contract.

Let’s review some of the top points of negotiation you may encounter:

Contingencies

Buyers may ask for the offer to be contingent on other factors, such as the sale of their existing home or their ability to obtain financing. They are also likely to include a home inspection contingency, which is a stipulation in the purchase agreement that says the buyer can inspect the home, top to bottom, and then decide whether to move forward with the purchase.

Finally, FSBO sellers should be aware of the home appraisal contingency, which buyers often add as protection if the appraised value comes in lower than the purchase price. A contingency-free contract is rare, but in a seller’s market, buyers are more likely to waive one or more to strengthen their offer.

Closing costs

Both buyer and seller will have costs to cover at settlement. However, some of these costs — such as title fees and escrow fees — can be negotiated in many instances.

A buyer may request that you pay a portion of their closing costs, but in a seller’s market, it’s more likely for sellers to either pay nothing or even ask that the buyer cover a portion of the fees to selling a house as a condition of the sale.

Repairs

Following the inspection, a buyer may ask you to make necessary repairs or provide monetary compensation based on an estimation of repair costs. You can either accommodate the request or do nothing. However, t the buyer can choose not to continue with the purchase if the results of the inspection aren’t satisfactory, unless they waive the home inspection contingency.

Closing date

Closing dates can be subject to negotiation as well. Buyers may need longer to secure financing, or sellers may ask for additional time to move out after closing. On the flip side, one party may ask for a quicker closing date to enable them to move faster if needed.

Earnest money

The earnest money deposit is typically a small amount of money that goes into an escrow account to show that the buyer is serious. The amount is negotiable, and it always goes toward the purchase price.

When buyers add contingencies to the contract, they can back out of the deal and get their earnest money back in certain circumstances, such as if anything unsatisfactory turns up on the inspection report. You’ll need to have a third-party account, such as with a title company, to hold the earnest money until closing.

Remember that even if you come to terms with your buyer verbally at first, you’ll want to put the offer in writing using a residential real estate purchase contract. A purchase contract is a legally binding document that protects the interests of both the seller and the buyer by specifically outlining expectations prior to closing.

To reduce the risk of errors for your sale, hire a real estate attorney to review the contract for you. They can advise you on the necessary steps in preparation for closing. A real estate attorney usually charges between $150 to $400 per hour.

Step 8: Complete the steps to closing

After you go under contract with the buyer and finalize the details of the purchase agreement, escrow opens. In Texas, real estate transactions are typically closed by escrow agents and title companies.

The buyer and seller can each propose their title company of choice but must ultimately agree on which company to work with to close the deal. In a hot seller’s market, buyers are more likely to offer to cover the title fees that sellers used to typically pay in Texas.

Before the deal is final, you can expect the following next steps to occur:

- Complete the home inspection, usually within five days to a week of signing the purchase agreement.

- Negotiate inspection items (if applicable).

- Complete home appraisal by a third-party independent appraiser (necessary if your buyer is using a mortgage).

- Negotiate appraisal results (if applicable).

- The buyer completes the final walkthrough to ensure the home is in “broom clean” condition, which means swept, vacuumed, and free of debris and excess stuff.

- The buyer ensures that no damage has been done to the property since their last visit.

Step 9: Close the sale

Texas is a “wet close” state, meaning that the funds are released from escrow as soon as all documents have been finalized –– or while the ink is still wet, so to speak.

Be aware that closing as a FSBO seller does not mean that you avoid all closing fees. Common seller closing fees include prorated property taxes and settlement fees, which can amount to around 1% to 3% of the sale price. Unlike most states, Texas does not charge a real estate transfer tax.

If a buyer uses an agent, a seller may also be asked to pay all or part of the buyer’s agent commission. Consult our guide on who pays for closing costs when selling a house by owner for more details.

The next steps likely include:

- Attorneys review documents for errors.

- Clear the title and resolve any title issues necessary to close.

- Transfer ownership of your home to the buyer at settlement.

- Funds are disbursed to the seller and other parties involved.

Review your settlement statement for a complete list of fees and credits of the sale.

Reminders for closing:

- Gather your title, loan documents, survey, insurance information, and any permits for renovations and have them ready for closing.

- Get your financial information ready for a final wire transfer.

- If you agree to make repairs based on the inspection, provide receipts to prove that the repairs have been completed.

Challenges Texas FSBO sellers face

Some Texas sellers may not bat an eyelash at the steps outlined above. But, many FSBO sellers find the actual execution a lot more challenging.

One major concern is the possibility of underselling the home. The NAR found that in 2023, FSBO homes sold at a median of $310,000, significantly lower than the median of agent-assisted homes, which was $435,000.

NAR also highlights which steps in the process FSBO sellers found to be the hardest:

- Getting the price right (17%)

- Selling within the length of time planned (13%)

- Understanding and performing paperwork (10%)

- Preparing of fixing up the home for sale (9%)

- Having enough time to devote to all aspects of the sale (5%)

Alternatives to selling a house by owner

There’s more than one way to sell a house. In addition to FSBO, below we list a few methods available to Texas sellers.

Option 1: Request a cash offer for your home

Another option for selling a house without a real estate agent is to work with an investor or house-buying company purchasing homes for cash in your area. Saving on commissions is often top of mind for FSBO sellers, and selling your house for cash is another option where you can do that.

A cash transaction can usually be turned over in as little as a week to two weeks, as it allows you to skip the mortgage process and the appraisal, which are typically the two most time-consuming steps.

If this option interests you, consider requesting a cash offer through HomeLight’s Simple Sale platform. Sellers using Simple Sale receive an all-cash offer within 24 hours and can close in as little as 10 days, with the flexibility of selecting a move-out date.

That said, it’s important to know that investors typically pay under-market value for the homes they purchase, and sometimes significantly so. Simple Sale shows you a side-by-side comparison of your cash offer amount against an estimation of what you could list for on the open market to help you make an informed decision.

Option 2: Hire a top Texas real estate agent

Research shows that agents statistically sell homes for more money, helping to offset or even exceed the amount paid in commission fees. And they do it while wrapping your entire listing and selling process in absolute professionalism.

Work with a top-rated agent, and the results are likely to be even better. Internal transaction data at HomeLight finds that the top 5% of real estate agents sell homes for as much as 10% more.

A real estate agent helps you fetch the highest sale price by putting together a beautiful listing, advising you on targeted upgrades, and negotiating the best price — and that’s just scratching the surface of their expertise.

Ready to sell your Texas home?

Going FSBO means handling everything yourself, from pricing and photography to marketing, showings, and negotiations. It’s time-consuming and often leads to lower sale prices than agent-assisted sales. However, if you’re committed to this route, make sure to follow the key steps outlined above, particularly pricing the home correctly, fixing it up for viewings, and managing disclosures.

On the other hand, if you’ve decided FSBO doesn’t align with your goals, consider working with an experienced agent who can help you sell for top dollar. Alternatively, you can partner with a homebuying company for an instant cash offer. Whether you’re looking for a quick sale through platforms like Simple Sale or need a skilled agent, HomeLight can guide you through a seamless home-selling experience in Texas.

Editor’s note: This blog post is intended for educational purposes only. Look into the real estate regulations for your area to properly navigate selling a home without a realtor. If you’ve explored the FSBO process and decide it’s not the right fit, we can connect you with top-rated agents for a stress-free, top-dollar sale.

Header Image Source: (Pete Alexopoulos / Unsplash)